India’s cement industry will see a tapering of demand growth to 6-7 per cent in fiscal 2025 after a third straight year of healthy demand growth at 11 per cent in fiscal 2024 to 441 million tonnes (MT). Cement volume growth recovered to a healthy 7-8 per cent on-year in the last quarter of fiscal 2024, on aggressive volume push, after growing 15 per cent on-year in the first half and logging a moderate slowdown in the third quarter due to regional hindrances. Production of cement, one of the economy’s eight infrastructure industries used to measure core sector growth, increased by 6.7 per cent on-year (provisional) in February 2024, as per Government data.

In fiscal 2025, CRISIL Research forecasts a 9-11 per cent correction in power and fuel cost led by softening of pet coke and coal prices. Freight expenditure is also expected to decline 1-3 per cent on the back of lower diesel prices, combined with players’ efforts to improve lead distances through aggressive expansions. According to Nomura, in 4QFY24F, the India cement industry saw a late recovery in demand from both trade and non-trade sectors resulting in strong volume growth. Analyst Jashandeep Singh Chad sees clinker utilisation levels to be 95 per cent for the top six cement manufacturers (in Nomura coverage universe) supported by pre-election demand.

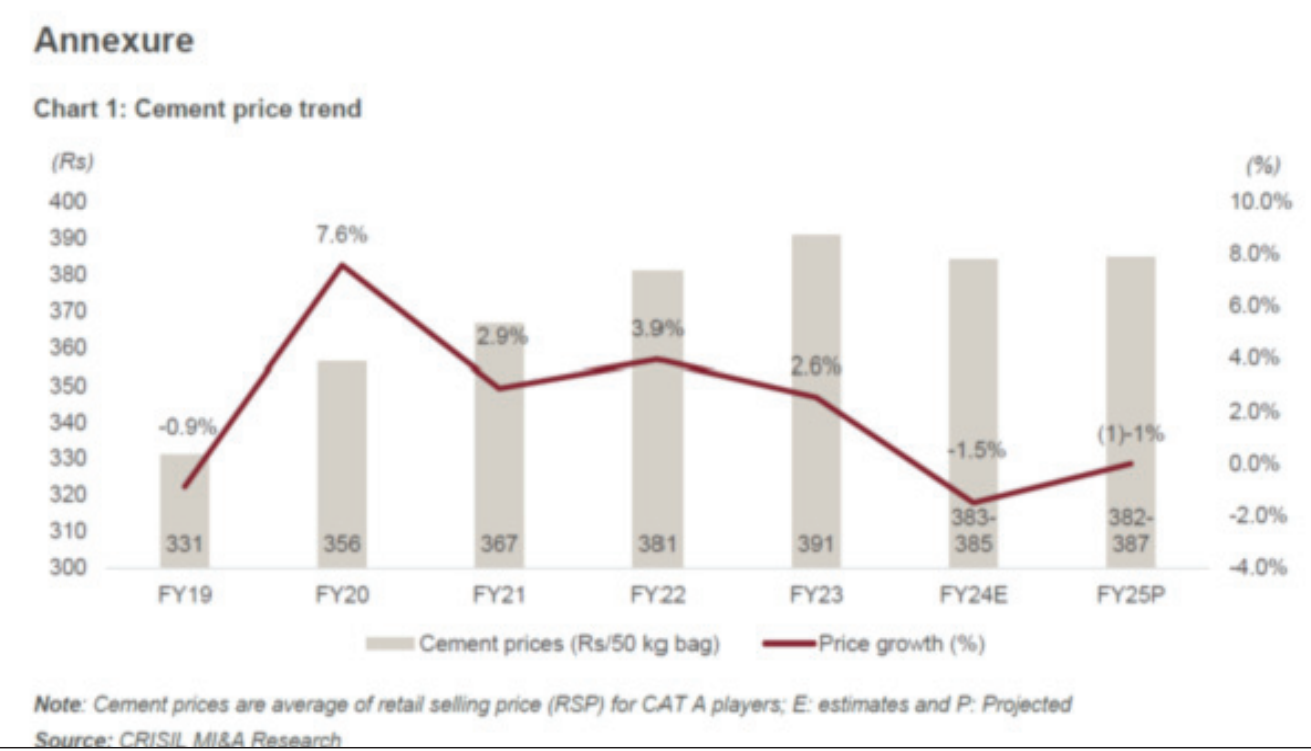

Benign costs are, however, expected to prop up cement industry profitability on-year. Pan-India cement prices took a beating in the second half of the fiscal amid increasing competition and higher supply in the market. Nomura Ratings points out that in April 2024, the cement industry announced significant price hikes of around Rs 20-50/bag, across the country, breaking the five-month price moderation streak, implying improvement in cement spreads for 1QFY25F. Prices have plunged by Rs 40-45 per bag in the five months (November 2023 – March 2024) since the last price hike in October 2023. Signaling elevated competitive intensity in the market, the months of January and February did not see sustained price hikes this year unlike the trend of firms pricing in the early months of Q4 (and a price drop in March due to the year-end volume push). Aggressive volume push at the expense of pricing resulted in a 6 per cent sequential decline in cement prices to Rs 370-375 on average per 50 kg bag in the fourth quarter, with exit prices in March at Rs 360-362 per bag. Thus, at the overall level, cement prices have been subdued, declining 1.5 per cent to Rs 383-385 per bag on average in fiscal 2024 from an all-time high of Rs 391 per bag in fiscal 2023.

According to Sehul Bhatt, Director-Research, CRISIL Market Intelligence and Analytics, there is heightened competitive intensity due to the entry of new players, 40-42 MT of capacity additions, and benign cost pressures which pushed cement price correction in fiscal 2024 after four consecutive years of price rise at a CAGR of 4 per cent from fiscal 2020 to fiscal 2023. In fiscal 2025, continued capacity expansion, declining cost pressures, and moderating demand are expected to limit any uptick and keep prices range-bound at (1)-1 per cent.

Cement manufacturers like Ambuja Cements, the cement and building material company of the diversified Adani Portfolio has signed a definitive agreement to acquire My Home Group’s 1.5 MTPA cement grinding unit in Tuticorin, Tamil Nadu. The acquisition at Rs 413.75 crore through internal accruals will aid in enhancing the coastal footprint across southern markets of Tamil Nadu and Kerala. The total cement capacity of Adani Group stands at 78.9 MTPA.

On the profitability front, benign costs brought a sigh of relief to players in fiscal 2024 despite subdued realizations. On an annual basis, power and fuel costs, accounting for 30-35 per cent of total costs, declined 16-18 per cent in fiscal 2024, mainly due to the dip in Australian coal prices by 58 per cent and international pet coke prices by 38 per cent on-year. As a result, profitability is expected to recover in fiscal 2024, with a 300-350 bps expansion, reaching 17 per cent.

Raw material costs, however, are expected to remain range-bound in fiscal 2025, with better availability of fly ash and slag limiting any significant increase. However, auctioning of limestone mines at premium bids should limit a sharper decline in raw material prices. The waning input costs are expected to lead to a further 100-150 bps margin expansion in fiscal 2025 to 18-20 per cent despite tapering realizations. The pace of key construction projects, the impact of monsoon on agricultural profitability, and the volatility of crude oil and coal prices due to geopolitical uncertainties will bear watching as these can swing profitability.

Opinion2 years ago

Opinion2 years ago

Fashion7 years ago

Fashion7 years ago

Entertainment7 years ago

Entertainment7 years ago

Entertainment7 years ago

Entertainment7 years ago

Opinion2 years ago

Opinion2 years ago

Business News2 years ago

Business News2 years ago

Policy&Politics2 years ago

Policy&Politics2 years ago

Business News2 years ago

Business News2 years ago