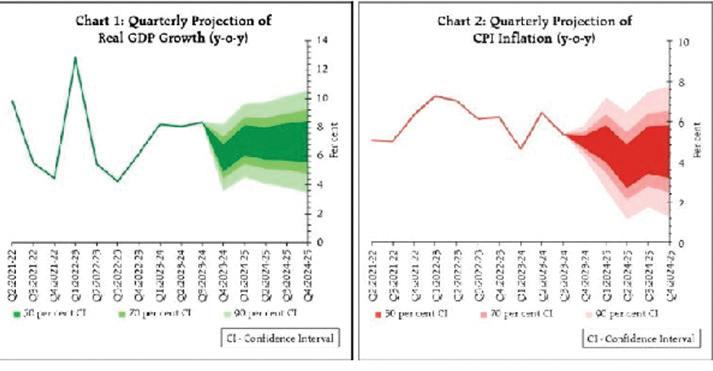

If the global economy is heading for a soft landing, there’s likely to be plenty of anxiety along the way. As the world’s financial elite gather in Washington for meetings of the International Monetary Fund, World Bank, and Group of 20, they’ll confront a mixture of slowing growth, stubborn inflation, high interest rates and debt levels, and market-rattling geopolitical risks.

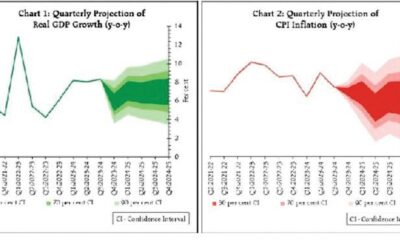

Bloomberg Economics now sees global activity slowing this year to 2.9 percent — a 0.2 percentage point upgrade from December in what it terms a “great escape” — but still “way below” the pre-pandemic pace.

IMF chief Kristalina Georgieva has signaled that the fund will also slightly raise its forecast, to be released Tuesday, from the current 3.1 percent while warning that the world is heading for “a sluggish and disappointing decade.”

Against that backdrop, investors will closely watch key attendees at the meetings. Scheduled speakers include Federal Reserve Chairman Jerome Powell, US Treasury Secretary Janet Yellen, UK Chancellor of the Exchequer Jeremy Hunt, and the heads of the European Central Bank, Bank of Japan, and Bank of England.

The politics of the moment have hamstrung the G-20 at recent gatherings, and it will likely again be unable to address risks that split its members.

“We have to buckle up for more to come, because it is a more diverse world,” Georgieva said when asked about geopolitical volatility. “And it is a world in which we have seen divergence, not just in economic fortunes but also divergence in objectives.”

Also in focus in the coming week will be the deep debt distress among several emerging market nations, which gorged for nearly two decades on cheap money, mostly from China. Now poor countries are struggling to regain access to capital as creditors fight for their share of the action, a competition with profound implications for Beijing’s influence over global finance.

“Relative to expectations that the price for taming runaway inflation would be a rash of recessions, a year of modestly slower global growth looks like a great escape.

The next big question – with growth surprisingly robust will central bank pivots be delayed? We’ve pushed back our call for a first Fed move to July — still earlier than many in the market expect.” —Tom Orlik, chief economist. For full analysis, click here

Elsewhere, Chinese economic data, UK inflation and wage numbers, and Canada’s budget will be among the key highlights.

US and Canada

The US data calendar kicks off Monday with retail sales, and economists project a moderate advance as the first quarter drew to a close, underscoring a resilient yet cautious consumer. The figures don’t take into account the impact of inflation and mostly reflect spending on merchandise. March data on inflation-adjusted purchases, including outlays for services, due later in the month will provide a more comprehensive view of household demand.

Among housing data in the coming week, a government report on Tuesday is seen showing that beginning home construction settled back in March after a solid February advance. Homebuilders have taken advantage of scant inventory in the resale market over the past year.

Existing-home sales figures on Thursday are projected to show a decline in March as elevated mortgage rates and prices continue to limit demand. After briefly falling below 7 percent, the average 30-year fixed mortgage rate has moved higher on expectations the Federal Reserve won’t be quick to lower borrowing costs.

The Fed’s public events calendar is chock full. Along with Powell on Tuesday, New York Fed President John Williams appears Monday on Bloomberg Television, and other appearances include Vice Chair Philip Jefferson as well as regional Fed presidents Mary Daly, Thomas Barkin, Loretta Mester, Austan Goolsbee, and Raphael Bostic.

Canadian inflation data for March, released on Tuesday, may show a slight uptick on higher gasoline prices. Core metrics will draw scrutiny, with Bank of Canada Governor Tiff Macklem looking for sustained downward momentum in underlying pressures before cutting rates.

Finance Minister Chrystia Freeland will release her budget the same day. She’s already announced multiple big-ticket items while pledging to keep the deficit at C$40 billion ($29.2 billion).

Opinion2 years ago

Opinion2 years ago

Fashion7 years ago

Fashion7 years ago

Entertainment7 years ago

Entertainment7 years ago

Entertainment7 years ago

Entertainment7 years ago

Opinion2 years ago

Opinion2 years ago

Business News2 years ago

Business News2 years ago

Policy&Politics2 years ago

Policy&Politics2 years ago

Business News2 years ago

Business News2 years ago