Business

Ramkrishna Forgings gets Rs 270 cr order for Vande Bharat train-set

The Daily Guardian is now on Telegram. Click here to join our channel (@thedailyguardian) and stay updated with the latest headlines.

For the latest news Download The Daily Guardian App.

Business

Apple plans to hire 500,000+ employees in India by 2027

Business

Metal price surge boosts Hindustan copper shares to 13-year high: up over 8%

Business

RIL net profit falls1.8% to Rs 18,951 cr yoy, revenue up 10.8 % on O2C, consumer biz

Business

Byju’s Pays Partial March Salaries Ahead of Investor Dispute Hearing

Auto

Tesla slashes prices by $2,000 on 3 EVs amid 39% YTD share drop due to falling sales

Auto

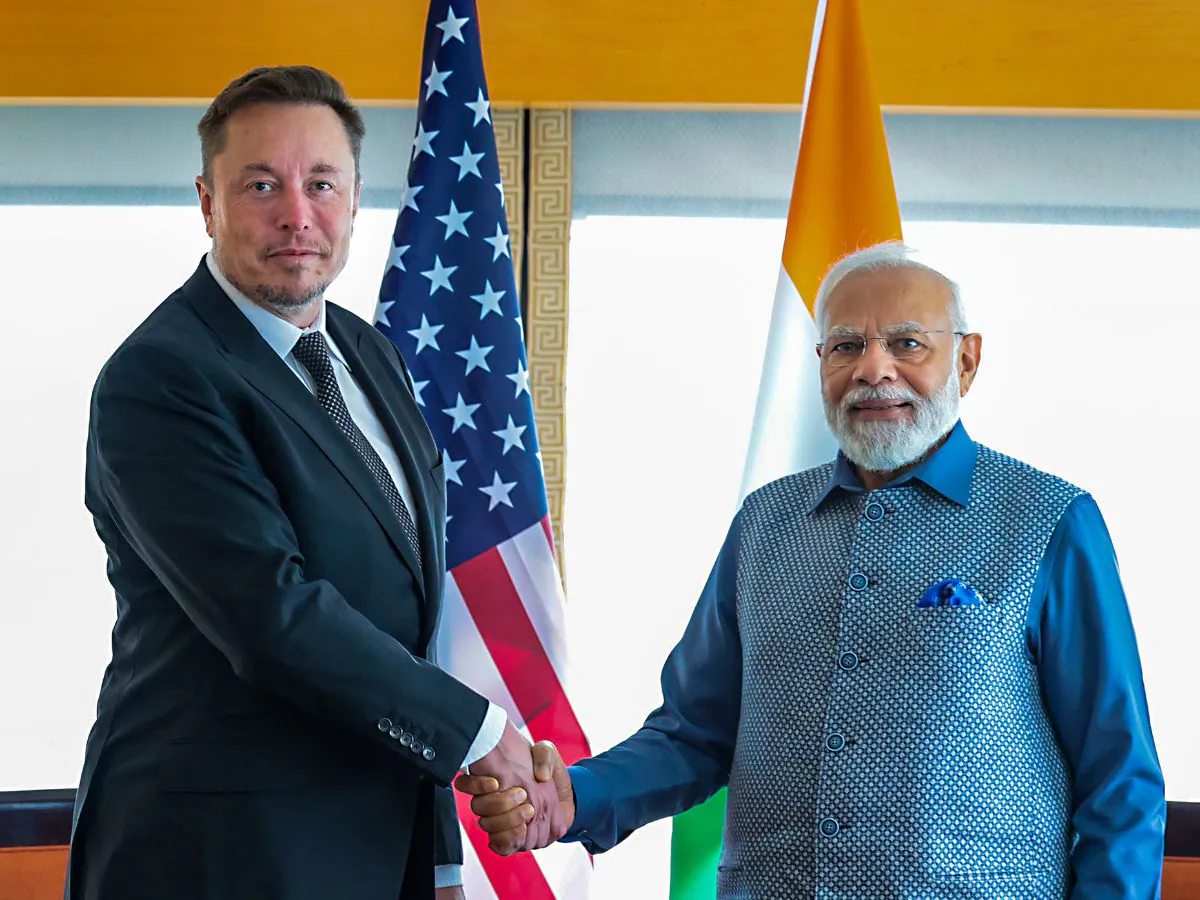

Musk delays India visit due to ‘Heavy Tesla obligations

-

Opinion2 years ago

Opinion2 years agoPakistan-China nexus trying to sow doubts in Indian society about governance systems

-

Fashion7 years ago

Fashion7 years agoThese ’90s fashion trends are making a comeback in 2017

-

Entertainment7 years ago

Entertainment7 years agoThe old and New Edition cast comes together to perform

-

Entertainment7 years ago

Entertainment7 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Opinion2 years ago

Opinion2 years agoEnvironment day with a missing spring and lost souls

-

Business News2 years ago

Business News2 years agoIndia Becomes World’s 5th Biggest Economy

-

Policy&Politics2 years ago

Policy&Politics2 years agoA successful SME must understand his 5 wives

-

Business News2 years ago

Business News2 years ago‘75K STARTUPS DEFINE THE POWER OF INNOVATION’