Business

Indian tech startups see sharp drop in layoffs, down 60% in Q1

The Daily Guardian is now on Telegram. Click here to join our channel (@thedailyguardian) and stay updated with the latest headlines.

For the latest news Download The Daily Guardian App.

Business

RIL net profit falls1.8% to Rs 18,951 cr yoy, revenue up 10.8 % on O2C, consumer biz

Business

Byju’s Pays Partial March Salaries Ahead of Investor Dispute Hearing

Auto

Tesla slashes prices by $2,000 on 3 EVs amid 39% YTD share drop due to falling sales

Auto

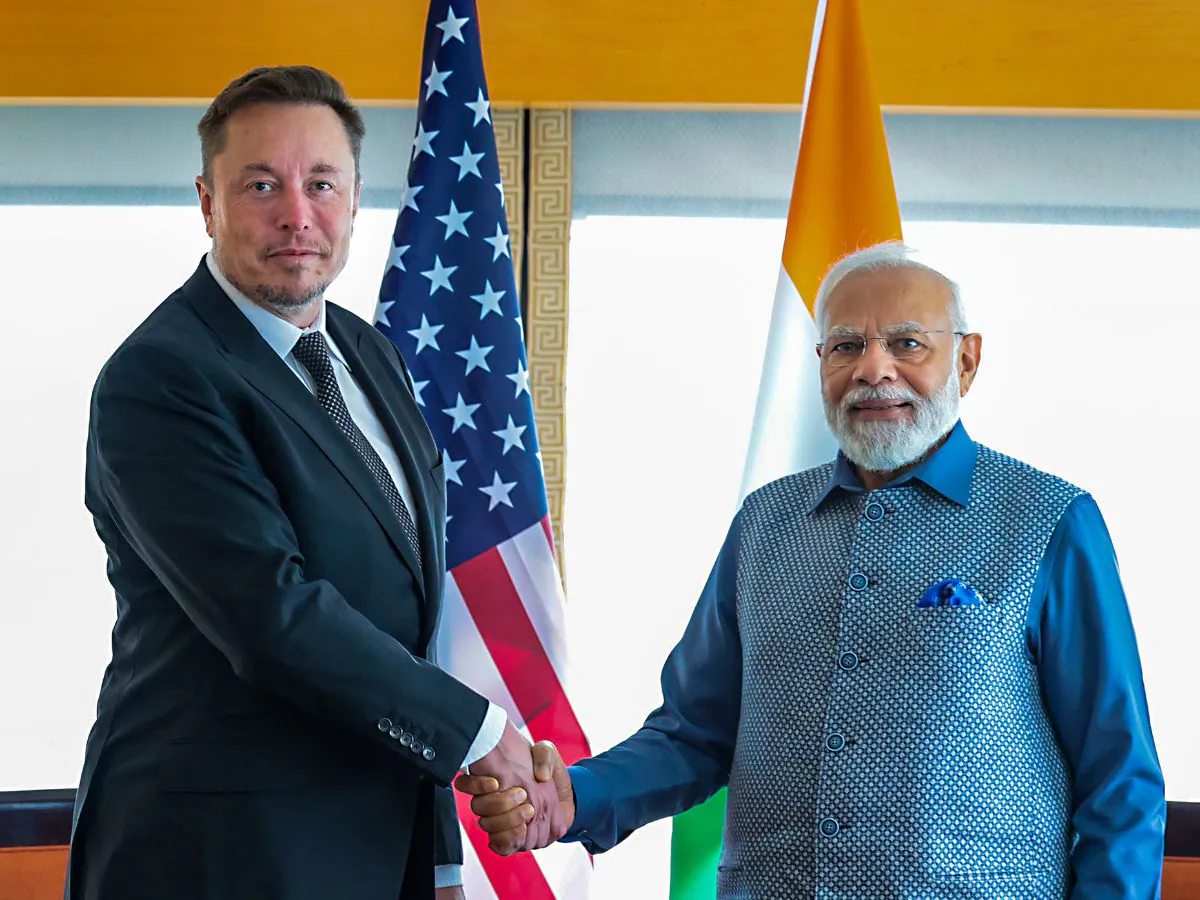

Musk delays India visit due to ‘Heavy Tesla obligations

Business

UltraTech acquires India cements’ 1.1 MTPA grinding unit for Rs 315 cr

Business

Netflix gains 9.33M users with originals, password sharing measures

-

Opinion2 years ago

Opinion2 years agoPakistan-China nexus trying to sow doubts in Indian society about governance systems

-

Fashion7 years ago

Fashion7 years agoThese ’90s fashion trends are making a comeback in 2017

-

Entertainment7 years ago

Entertainment7 years agoThe old and New Edition cast comes together to perform

-

Entertainment7 years ago

Entertainment7 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Opinion2 years ago

Opinion2 years agoEnvironment day with a missing spring and lost souls

-

Business News2 years ago

Business News2 years agoIndia Becomes World’s 5th Biggest Economy

-

Policy&Politics2 years ago

Policy&Politics2 years agoA successful SME must understand his 5 wives

-

Business News2 years ago

Business News2 years ago‘75K STARTUPS DEFINE THE POWER OF INNOVATION’