Hyundai Motor India registered total sales of 63701 units in April 2024, a 9.5 per cent growth year-on-year with domestic sales at 50201 units, driven by SUVs which contributed 67 per cent of HMI domestic sales. Exports at 13,500 units grew 58.8 per cent yoy. Tarun Garg, COO, Hyundai Motor India points out that April 2024 marked fourth consecutive month of 50,000 plus units in domestic sales during calendar year 2024 driven by models like the CRETA, VENUE and EXTER. Honda Cars India (HCIL), registered total sales of 10,867 units in April 2024 as compared to 7,676 units in the same month last year. The company registered 4,351 units in domestic sales and 6,516 units in exports in the month of April’24.

Kunal Behl, Vice President, Marketing & Sales points out that the planned production volumes in April were lower due to switchover of Elevate and City production to six-airbag standard variants. “The dispatches were aligned accordingly. On the other hand, export of Elevate continues to significantly boost HCIL export volume which grew by 175 per cent over same period last year,” says Behl. The company had registered 5,313 units in domestic sales and exported 2,363 units in April’ 23. Maruti Suzuki India sold 1,68,089 units in April 2024, including domestic sales of 140,448 passenger vehicles and light commercial vehicles, sales to other OEM of 5,481 units and exports of 22,160 units.

The total sales in April 2024 was an increase of 4.7 per cent compared with the year-ago period. The company’s exports grew 30.6 per cent. as against 1,39,519 units in the corresponding period a year ago. The car maker sold 1,39,519 units domestically in the corresponding period a year ago, showing 0.7 per cent growth in April 2024. The company also announced the commencement of pre-bookings for the highly anticipated 4th generation Epic New Swift for INR 11,000. Partho Banerjee, Senior Executive Officer, Marketing & Sales points out that the Swift has been an iconic brand for Maruti Suzuki, with 29 lakh strong customer base. “The Epic New Swift stays true to its much-loved sporty DNA, while balancing new-age expectations of environment friendliness with low emissions.

The next-generation Swift is all set to create new benchmarks in the premium hatchback segment,” says Banerjee. Tata Motors Limited sales in the domestic and international market for April 2024 stood at 77,521 vehicles, compared to 69,599 units during April 2023, rising 11.5 per cent year-on-year as compared with 69,599 units in April 2023. The company’s total domestic dispatches rose 12 per cent to 76,399 units last month as against 68,514 units in April 2023. Domestic sale of MH&ICV in April 2024, including trucks and buses, stood at 12,722 units, compared to 8,985 units in April 2023 while total sales for MH&ICV domestic and international business in April 2024, including trucks and buses, stood at 13,218 units compared to 9,515 units in April 2023.

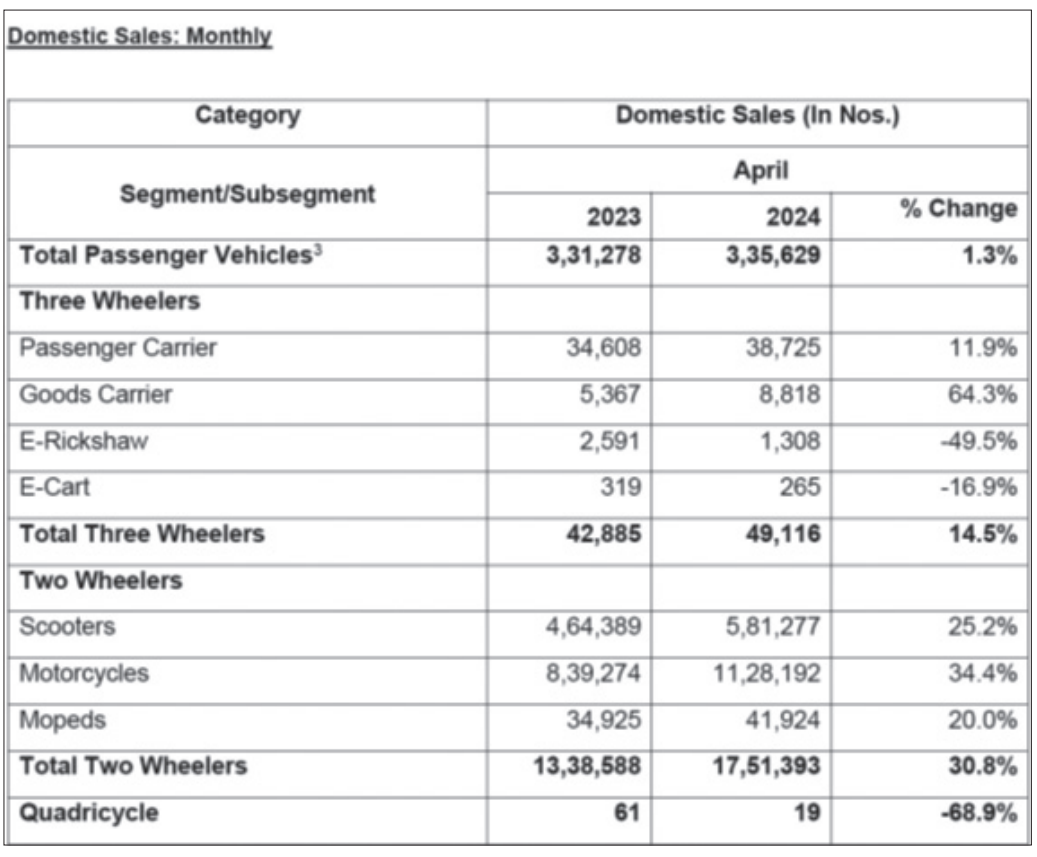

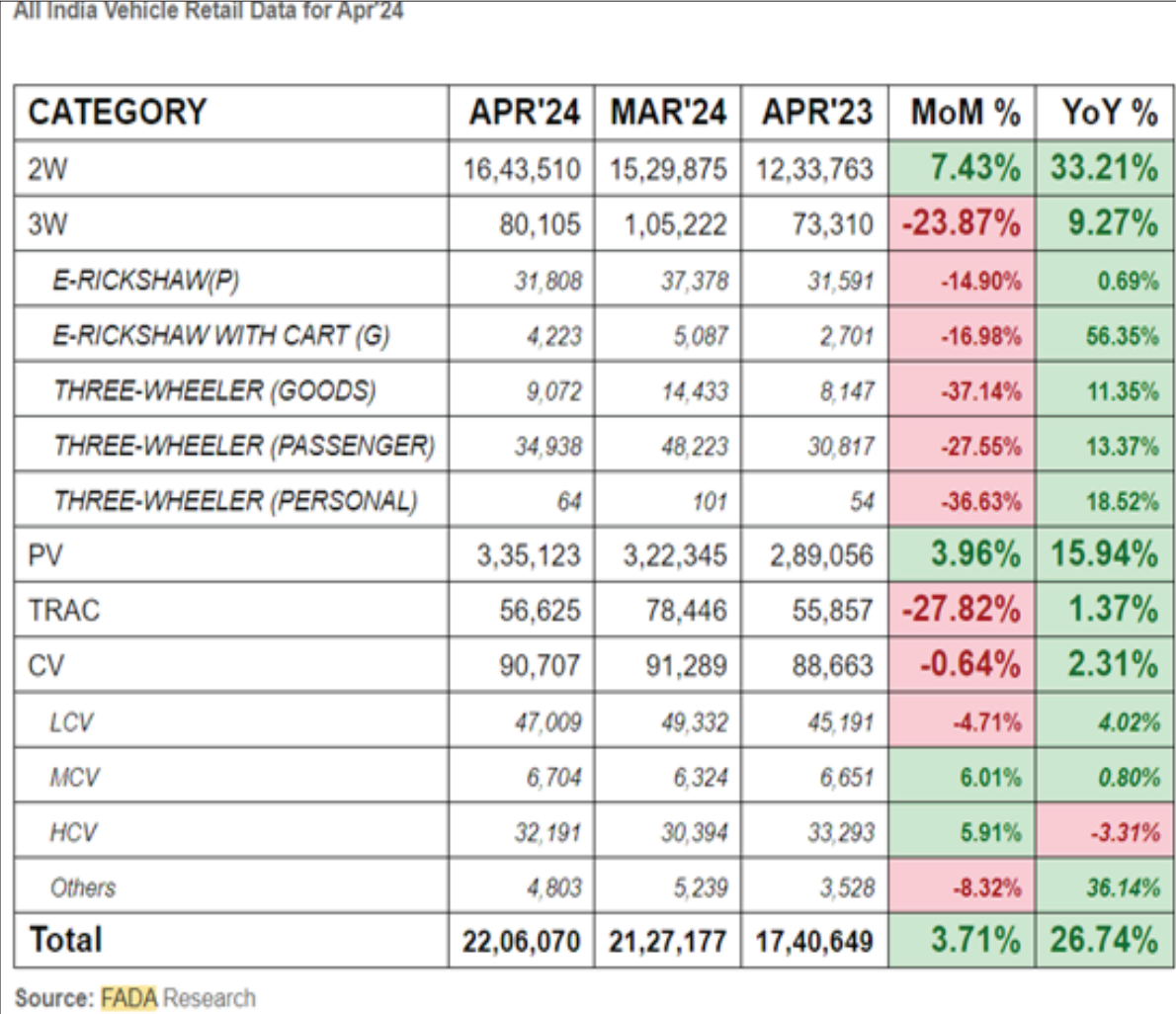

Toyota Kirloskar Motor (TKM) sold 20,494 units in the month of April 2024, representing a yoy growth of 32 per cent, as compared to April 2023, where the company sold 15,510 units. The growth momentum was sustained despite a weeklong maintenance shutdown from April 06-14, 2024, for upkeep of machinery and equipment to sustain operational efficiencies, productivity and safety. In the current month, domestic sales accounted for 18,700 units while exports totalled to 1,794 units during the same month. Chennai based TVS Motor Company registered a growth of 25 per cent with sales increasing from 306,224 units in April 2023 to 383,615 units in April 2024.

Total two-wheelers registered a growth of 27 per cent with sales increasing from 294,786 units in the month of April 2023 to 374,592 units in April 2024. Domestic two-wheeler registered growth of 29 per cent with sales increasing from 232,956 units in April 2023 to 301,449 units in April 2024. Motorcycle registered a growth of 24 per cent with sales increasing from 152,365 units in April 2023 to 188,110 units in April 2024. Scooter registered a growth of 34 per cent with sales increasing from 107,496 units in April 2023 to 144,126 units in April 2024.

The company recorded electric vehicles sales of 17,403 units in April 2024, indicating continued robust demand. Electric vehicle sales last year in April 2023 were at 6,227 units. The Company’s total exports registered a growth of 12 per cent with sales increasing from 71,663 units in April 2023 to 80,508 units in April 2024.

Opinion2 years ago

Opinion2 years ago

Fashion7 years ago

Fashion7 years ago

Entertainment7 years ago

Entertainment7 years ago

Entertainment7 years ago

Entertainment7 years ago

Opinion2 years ago

Opinion2 years ago

Business News2 years ago

Business News2 years ago

Policy&Politics2 years ago

Policy&Politics2 years ago

Business News2 years ago

Business News2 years ago