Pakistan aims to rollover $12 billion debt from key allies and negotiate new financing from China to address its external financing gap, as disclosed by Finance Ministry insiders.

Pakistan has decided to seek a rollover of approximately $12 billion in debt from key allies like China in the upcoming fiscal year of 2024-25 to bridge a significant $23 billion gap in its external financing. The aim is to meet budget targets before the anticipated arrival of an International Monetary Fund (IMF) team to address the country’s financial challenges.

Finance Ministry insiders disclosed that Pakistan plans to rollover $5 billion from Saudi Arabia, $3 billion from the UAE, and $4 billion from China. Additionally, the estimated budget for the next fiscal year includes new financing from China, with negotiations expected to commence in mid-May ahead of the budget presentation in June.

The federal government aims to achieve budget targets prior to the IMF review mission’s arrival, instructing ministries to complete set targets before negotiations on the new loan program. The details will be provided to the IMF delegation once these targets are met. Furthermore, the budget strategy paper is set to be approved by the federal cabinet before the IMF review mission’s visit.

The Finance Ministry has initiated preparations for the budget, outlining targets for debt repayment, defense budget, and tax collections. Additionally, development and ongoing budget targets will be determined as part of the budget preparation process.

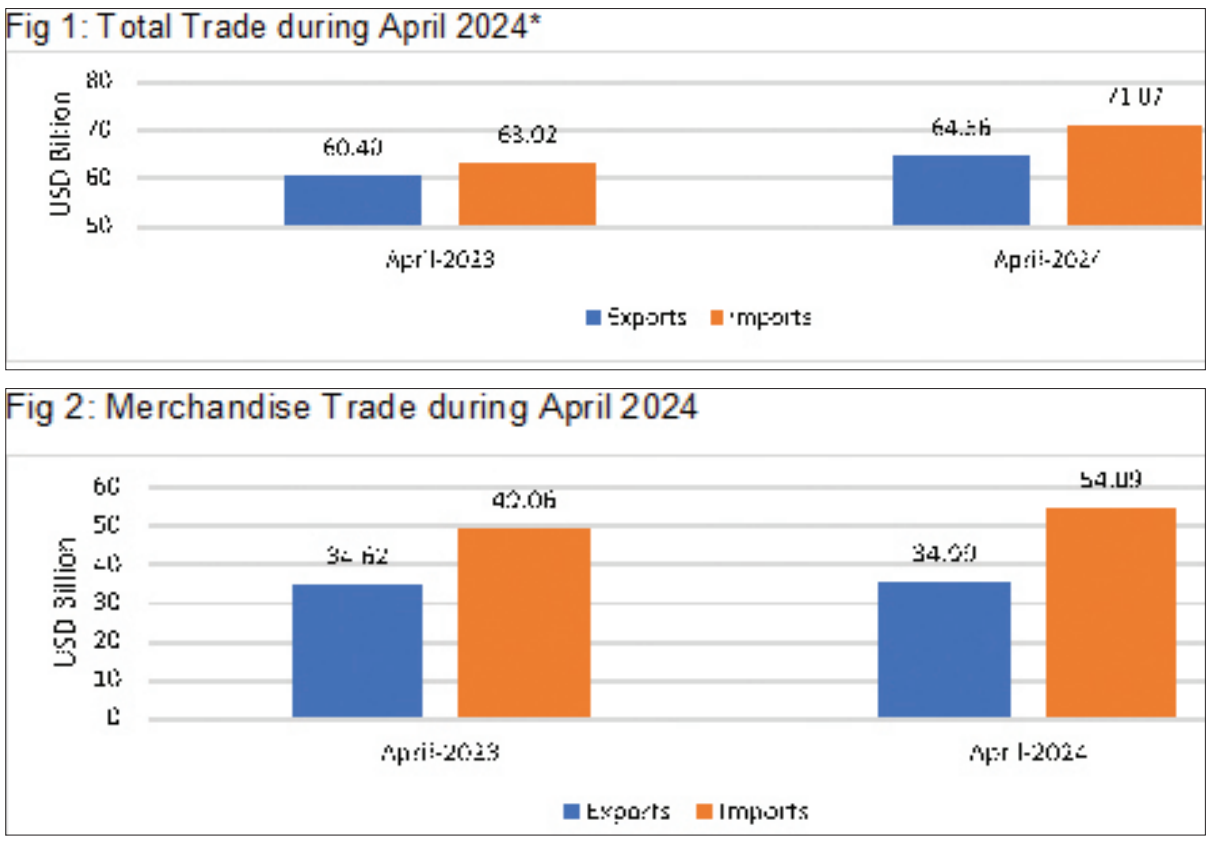

Pakistan has long grappled with meeting its external liabilities, relying on remittances, export proceeds, and foreign loans. However, exports have not kept pace with imports, and avenues for foreign aid have diminished, straining the economy and essential imports. Last year, Pakistan narrowly avoided default through a short-term loan agreement with the IMF, providing $3 billion over nine months. Now, the country seeks a fresh loan to address its economic challenges.

Remittances from Pakistani workers abroad have been a significant source of support, with the country receiving the second-highest remittances of the ongoing fiscal year at $2.8 billion in April 2024. According to the State Bank of Pakistan, remittances increased by 3.5 percent to $23.8 billion in the first 10 months of FY24 compared to the same period last year. Remittance inflows in April 2024 were primarily from Saudi Arabia, the United Arab Emirates, the United Kingdom, and the United States. These remittances peaked near $3 billion in March 2024, marking a 23-month high.

Separately, Pakistan is engaging with Chinese leadership to revive over 1800-megawatt hydropower projects and attract investment from new Chinese companies in the transmission and distribution network as part of the second phase of the China-Pakistan Economic Corridor (CPEC). A high-level delegation led by Planning Minister Ahsan Iqbal is currently in China to pursue existing investors and financial institutions and tap into more firms in the transmission and distribution network.

In his meeting, Iqbal sought China’s continued cooperation in the early implementation of hydropower projects. Both sides agreed to hold the next round of the Joint Working Group meeting on Energy soon.

In summary, Pakistan’s efforts to address its financial challenges involve seeking debt rollovers, securing new financing, and leveraging remittances from overseas workers. Additionally, the country is pursuing collaboration with China to advance key infrastructure projects under the CPEC. These measures aim to stabilize Pakistan’s economy and pave the way for sustainable growth.

Pakistan’s financial landscape reflects a complex interplay of domestic and international factors, where strategic alliances, economic policies, and global partnerships intersect to shape the nation’s economic trajectory. Amidst the ongoing challenges, the country’s leadership remains focused on addressing fiscal deficits, meeting external financing requirements, and fostering economic resilience.

The decision to seek a rollover of debt from key allies like China underscores Pakistan’s efforts to navigate its external financing gap and stabilize its economy. By engaging with strategic partners, Pakistan aims to alleviate immediate financial pressures and create a conducive environment for sustainable growth. The reliance on debt rollovers reflects the intricacies of managing external liabilities while balancing fiscal obligations and developmental priorities.

At the heart of Pakistan’s financial strategy lies the imperative to achieve budget targets and address structural imbalances before the anticipated arrival of an IMF team. The proactive approach adopted by the federal government underscores a commitment to fiscal prudence and proactive economic management. By setting clear targets and mobilizing resources, Pakistan aims to strengthen its financial position and bolster investor confidence.

The forthcoming negotiations with the IMF represent a critical juncture in Pakistan’s economic trajectory, offering an opportunity to realign policies, implement reforms, and chart a path towards sustainable development. The willingness to engage constructively with international financial institutions reflects a recognition of the importance of external support in addressing economic challenges and unlocking growth potential.

Against the backdrop of economic reforms and financial restructuring, Pakistan’s reliance on remittances emerges as a crucial lifeline, providing vital support to the economy amidst external pressures. The resilience of remittance inflows underscores the resilience of Pakistan’s diaspora community and their enduring commitment to the country’s development. By harnessing the potential of remittances, Pakistan can diversify its funding sources, reduce dependency on external loans, and promote inclusive growth.

The engagement with China under the auspices of the China-Pakistan Economic Corridor (CPEC) represents a cornerstone of Pakistan’s economic agenda, offering a transformative vision for infrastructure development, energy security, and regional connectivity. The revival of hydropower projects and investment in transmission and distribution networks signal a renewed commitment to advancing strategic initiatives that stimulate growth, create employment opportunities, and enhance energy access. The ongoing dialogue with Chinese leadership underscores the depth of the bilateral partnership and the mutual commitment to realizing shared objectives. By leveraging China’s expertise, resources, and technology, Pakistan can accelerate the pace of infrastructure development and unlock the full potential of the CPEC. The collaboration between the two countries exemplifies the principles of South-South cooperation and the potential for mutually beneficial partnerships in driving sustainable development.

As Pakistan navigates the complex terrain of economic reform and restructuring, the imperative of inclusive growth and social development remains paramount. The commitment to inclusive policies, poverty alleviation, and social protection underscores a holistic approach to economic governance that prioritizes the well-being of all citizens. By investing in human capital, social infrastructure, and equitable opportunities, Pakistan can lay the foundation for long-term prosperity and resilience.

In a nutshell, Pakistan’s economic journey reflects a multifaceted tapestry of challenges, opportunities, and strategic imperatives. By embracing a proactive approach to fiscal management, engaging constructively with international partners, and harnessing the potential of remittances and strategic alliances, Pakistan can chart a course towards sustainable development and prosperity. The path ahead may be fraught with obstacles, but with resilience, determination, and strategic vision, Pakistan can overcome challenges and realize its full potential on the global stage.

Opinion3 years ago

Opinion3 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Fashion8 years ago

Fashion8 years ago

Opinion4 years ago

Opinion4 years ago

Entertainment8 years ago

Entertainment8 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago