Economy

India’s Forex Reserves Surge for Seventh Consecutive Week, Attain New High

The Daily Guardian is now on Telegram. Click here to join our channel (@thedailyguardian) and stay updated with the latest headlines.

For the latest news Download The Daily Guardian App.

International Relations

China Vows firm response to US tariff hike

Economy

RBI warns NBFCs to stay alert for financial system risks

Economy

India cuts oil windfall tax again, now down to Rs 5,700 per tonne

International Relations

French Summit sees tech & aero deals, TCS & Motherson invest

International Relations

India and Iran vow to deepen maritime ties

Economy

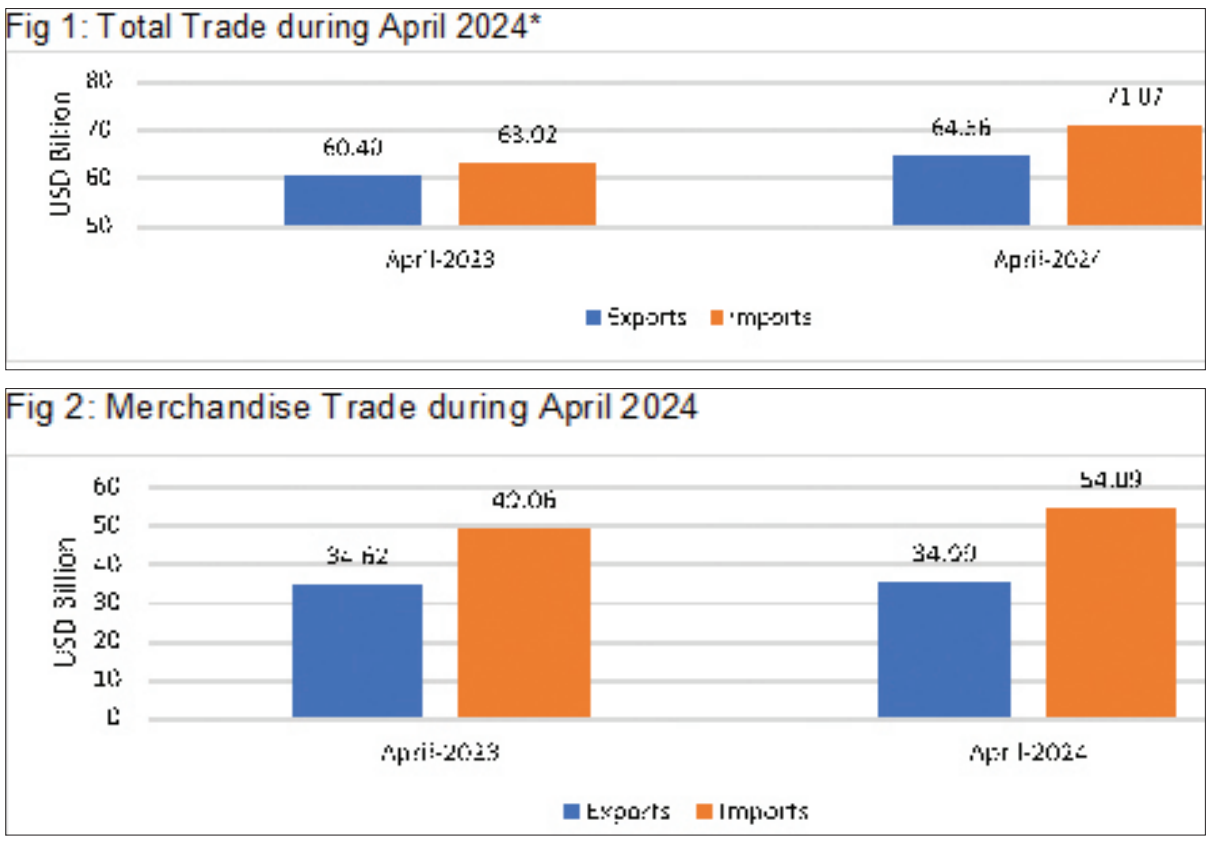

India’s merchandise exports grow marginally by 1.08 % to $ 34.99 bn

-

Opinion3 years ago

Opinion3 years agoPakistan-China nexus trying to sow doubts in Indian society about governance systems

-

Entertainment8 years ago

Entertainment8 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2017

-

Opinion4 years ago

Opinion4 years agoEnvironment day with a missing spring and lost souls

-

Entertainment8 years ago

Entertainment8 years agoNew Season 8 Walking Dead trailer flashes forward in time

-

Politics8 years ago

Politics8 years agoIllinois’ financial crisis could bring the state to a halt

-

Entertainment8 years ago

Entertainment8 years agoMod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens