The GST collection figures, notes Aditi Nayar, Chief Economist, ICRA, displays an impressive double-digit expansion and reflecting the collections for the previous month, which typically include year-end adjustments made by the taxpayers.

Underscoring the robust health of the Indian economy, gross Goods and Services Tax (GST) collections hit a record high in April 2024 at ₹2.10 lakh crore, representing a significant 12.4 per cent year-on-year growth. The surge was driven by a strong increase in domestic transactions which registered 13.4 per cent increase and imports which accounted for 8.3 per cent increase, the Finance Ministry said on Wednesday. After accounting for refunds, the net GST revenue for April 2024 stands at ₹1.92 lakh crore, reflecting an impressive 15.5 per cent growth compared to the same period last year.

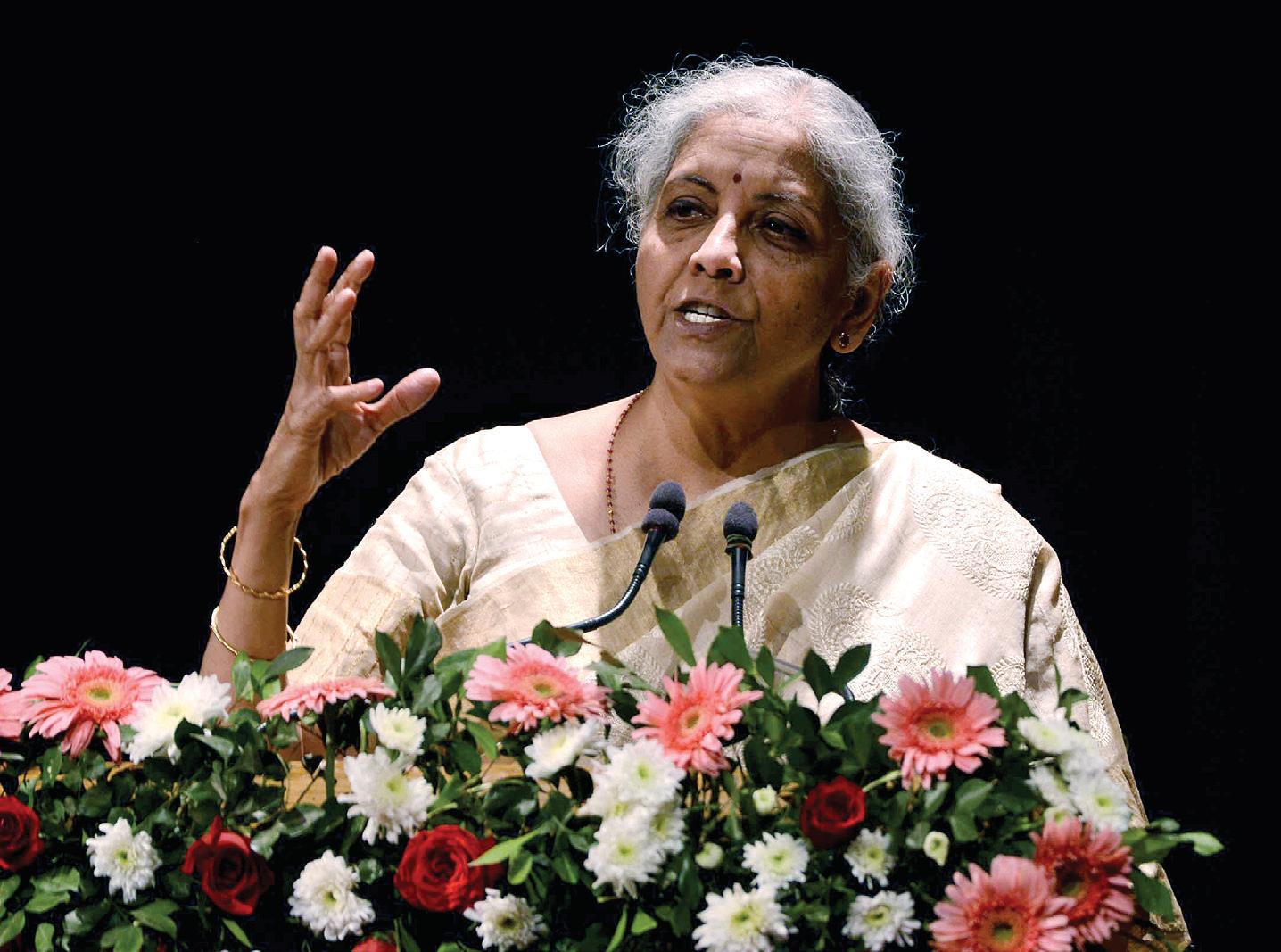

“GST collection crosses ₹ 2 lakh crore benchmark,” said Finance Minister Nirmala Sitharaman in a tweet, attributing the achievement to “the strong momentum in the economy and efficient tax collections. “Congratulations to the Central Board of Indirect Taxes & Customs, Department of Revenue, all officers at the state and central levels. Their sincere and collaborative efforts has achieved this landmark,“ Sitharaman said. The finer print of April 2024 collections reflects positive performance across components with Central GST (CGST) at ₹43,846 crore and state GST (SGST) at ₹53,538 crore. The integrated GST (IGST) collection was ₹99,623 crore, including ₹37,826 crore collected on imported goods.

The cess collection was ₹13,260 crore, including ₹1,008 crore collected on imported goods. The GST collection figures, notes Aditi Nayar, Chief Economist, ICRA, displays an impressive double-digit expansion and reflecting the collections for the previous month, which typically include year-end adjustments made by the taxpayers. In the month of April, 2024, the Central Government settled ₹50,307 crore to CGST and ₹41,600 crore to SGST from the IGST collected. This translates to a total revenue of ₹94,153 crore for CGST and ₹95,138 crore for SGST for April 2024 after regular settlement. “This IGST settlement of ₹91907 crore is ₹4,413 crore more than the actual net IGST collections of ₹87,494 crore and stands settled by the Central Government. There are no dues pending on account of IGST settlement to the states,” the Finance Ministry said.

Economists have lauded the GST collections with Shravan Shetty, Managing Director at Primus Partners observing that the 12.4 per cent y-o-y increase in GST points to the fact that growth is driven by both an increase in goods produced and the formalisation of the economy driven by increasing compliance. “April typically has the highest collection of GST in a year as seen last year,” points out Shetty, who expects coming months to be close to the 1.7-2 lakh crore mark which should pick up as India enters the festive season post rainy season.

Key factors to consider for the coming months, as per Shetty, would be the current heat wave and the impact of it on manufacturing and services output. “Also, the coming monsoon will impact the agricultural and rural economy which will determine GDP growth and GST collections in the second half of the year,” Shetty adds. Nayar anticipates that the CGST collections exceeded the FY2024 revised estimate by Rs 250- 300 billion, suggesting an embedded growth of 9 per cent to meet the target set in the Interim Budget Estimates for FY2025,” said Nayar. According to the Finance Ministry’s monthly economic review last month, March 2024 witnessed a significant milestone in India’s tax revenue landscape, particularly in GST collections.

The gross GST revenue for the month stood at an impressive ₹1.78 lakh crore, a substantial 11.5 per cent year-on-year growth. The increase was primarily driven by domestic transactions that witnessed a huge surge. Collection from domestic transactions signifies a buoyant domestic economic landscape, instilling optimism and bolstering overall revenue accruals.

Furthermore, the steady rise in average monthly collections by approximately ₹18,000 crore throughout the year underscores a compelling narrative of robust growth and economic recovery. With March concluding the fiscal year 2024, the uptick in GST collections not only reflects robust compliance but also signifies an expansion in the ambit of GST, covering a broader spectrum of economic activities within its purview, the Finance Ministry said.

Opinion2 years ago

Opinion2 years ago

Fashion7 years ago

Fashion7 years ago

Entertainment7 years ago

Entertainment7 years ago

Entertainment7 years ago

Entertainment7 years ago

Opinion2 years ago

Opinion2 years ago

Business News2 years ago

Business News2 years ago

Policy&Politics2 years ago

Policy&Politics2 years ago

Business News2 years ago

Business News2 years ago