Business activity increased across the four sub-categories monitored by the survey, led by steep growth in finance and insurance.

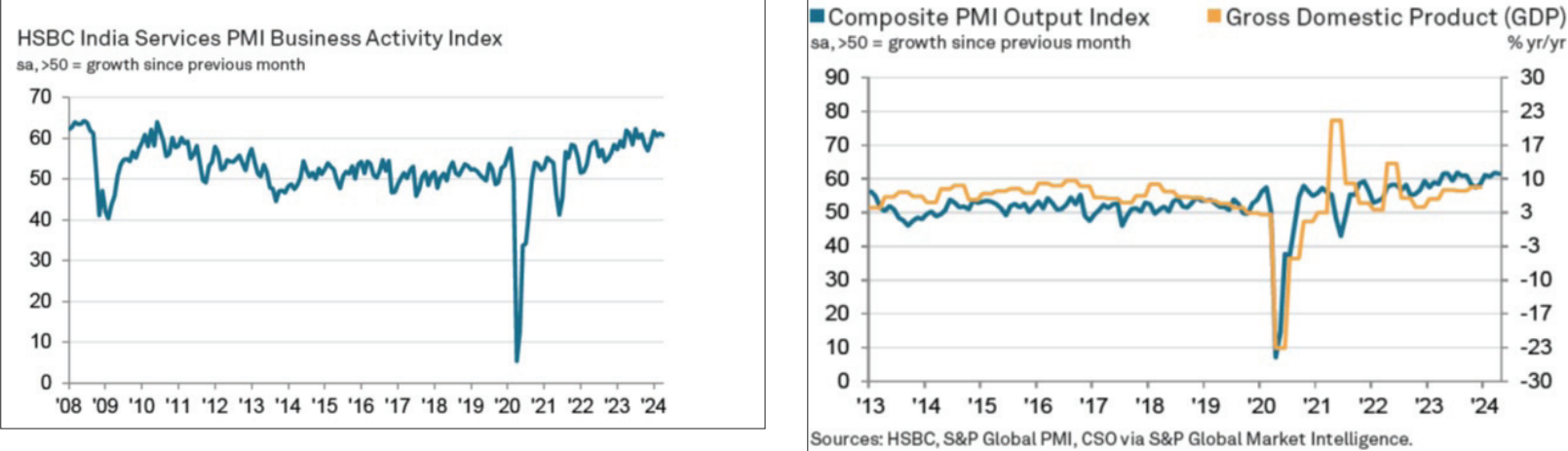

India’s service sector made a strong start to the first fiscal quarter as new business in terms of total sales and output registered the sharpest expansion in 14 years, taking the seasonally adjusted HSBC India Services Business Activity Index to 60.8 in April.

Despite falling from 61.2 at the end of the previous fiscal quarter, last month saw the second-fastest rise in international orders in series history, as a near-record upturn in services exports helped boost sales growth on the back of favorable economic conditions, demand strength, and rising intakes of new work.

Business activity increased across the four sub-categories monitored by the survey, led by steep growth in finance and insurance. In addition to buoyant domestic demand, firms noted new business gains from several parts of the world, which collectively underpinned the second-quickest upturn in international sales since the series started in September 2014.

Notably, services companies observed the second-fastest increase in new export business in the near 10-year series history, behind only that seen in March, buoyed by gains from several countries in Asia, Africa, Europe, the Americas, and Middle East.

Outstanding business, meanwhile, increased for the 28th consecutive month in April, albeit at a slight pace that was softer than in March and broadly aligned with the average over this sequence.

According to Pranjul Bhandari, Chief India Economist at HSBC, India’s service activity rose at a slightly softer pace in April, backed by a further rise in new orders, with notable strength in domestic demand. “Although new export orders remained robust, they showed a slight moderation from March figures. Overall confidence among service providers for the year-ahead outlook improved markedly, bolstered by resilient demand conditions. In terms of overall activity, aggregate output across both the manufacturing and service sectors rose significantly in April, albeit at a slightly slower pace, indicating sustained health in these sectors,” says Bhandari.

Wage pressures and higher food prices, meanwhile, led to another increase in cost burdens, which firms partially passed on to their customers. Charge inflation eased from March’s near seven-year high, however. Amid reports of higher input (particularly fruits and vegetables) and labor costs, operating expenses continued to increase in April. The overall rate of inflation pulled back since March and was broadly aligned with its long-run average.

The consumer services segment saw by far the sharpest increase in input costs. A backdrop of robust underlying demand enabled service providers to pass part of their additional cost burdens through to clients in the form of increased charges. The rate of selling price inflation eased from March’s near seven-year high and was close to its long-run trend.

Buoyed by rising inflows of new business, a few service providers in India showed an increased appetite for new hires in April. That said, with several companies indicating that payroll numbers were sufficient for current requirements, the rate of job creation was marginal and softer than that seen at the end of the previous fiscal year.

Finally, confidence among service providers towards the year-ahead outlook for business activity improved to a three-month high. Marketing efforts and efficiency gains, alongside plans to price competitively and predictions that demand conditions will remain favorable, boosted optimism.

The final HSBC India Composite index also signaled a substantial rate of expansion across the private sector, reading at 61.5 in April (March: 61.8), — one of the highest seen in close to 14 years. It, however, came in below the flash estimate. As was the case for output, manufacturers continued to note a stronger increase in new business intakes than service providers. Aggregate sales rose sharply, and at one of the fastest rates since mid-2010. Goods producers also led April’s rise in payroll numbers, with softer growth in the service economy curbing job creation at the composite level.

Aggregate input costs across India rose moderately at the start of the first fiscal quarter. The rate of inflation was softer than in March and below its long-run average. Here, the stronger increase was registered in the service sector. Moderate increases in selling prices were recorded at manufacturing firms and their services counterparts. Across the private sector, charge inflation softened since March.

Opinion2 years ago

Opinion2 years ago

Fashion7 years ago

Fashion7 years ago

Entertainment7 years ago

Entertainment7 years ago

Entertainment7 years ago

Entertainment7 years ago

Opinion2 years ago

Opinion2 years ago

Business News2 years ago

Business News2 years ago

Policy&Politics2 years ago

Policy&Politics2 years ago

Business News2 years ago

Business News2 years ago