India’s factory output, measured by the Index of Industrial Production (IIP), in March 2024 posted 4.9 per cent year-on-year growth, moderating from 5.6 per cent in February 2024 and ending fiscal 2024 on a sober note. The IIP growth was led by a robust expansion in electricity even as manufacturing growth rose to a five-month high, albeit on a very low base.

The growth rate of the mining sector for the month of March 2024 over March 2023 was 1.2 per cent, manufacturing grew 5.2 per cent yoy while the growth rate of electricity for the month of March 2024 was 8.6 per cent more than that in March 2023, as per Government data on Friday. Within the manufacturing sector, the top three positive sectoral contributors to the growth of IIP for the month of March 2024 are ‘basic metals with 7.7 per cent growth, pharmaceuticals, medicinal chemical and botanical products with growth of 16.7 per cent and manufacture of other transport equipment with growth of 25.4 per cent.

Dharmakirti Joshi, Chief Economist, CRISIL notes that the slowdown in March was driven by infrastructure and construction goods, which reflects moderating government capital expenditure at the end of the fiscal. “Among consumer products, while durables slowed, non-durables revived this month, hinting at a moderation in urban demand and a revival in rural demand,” says Joshi.

According to CRISIL, the IIP had increased to 5.7 per cent on-year in February from 4.1 per cent in January, boosted by healthy performance in both consumption and industrial sectors. Meanwhile, January’s reading was revised up from the previous estimate of 3.8 per cent as IIP growth picked up in all three subsectors of manufacturing, mining, and electricity.

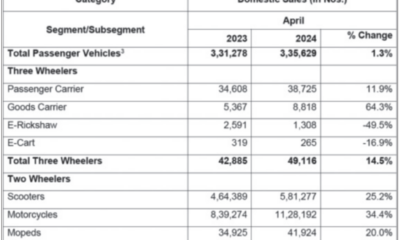

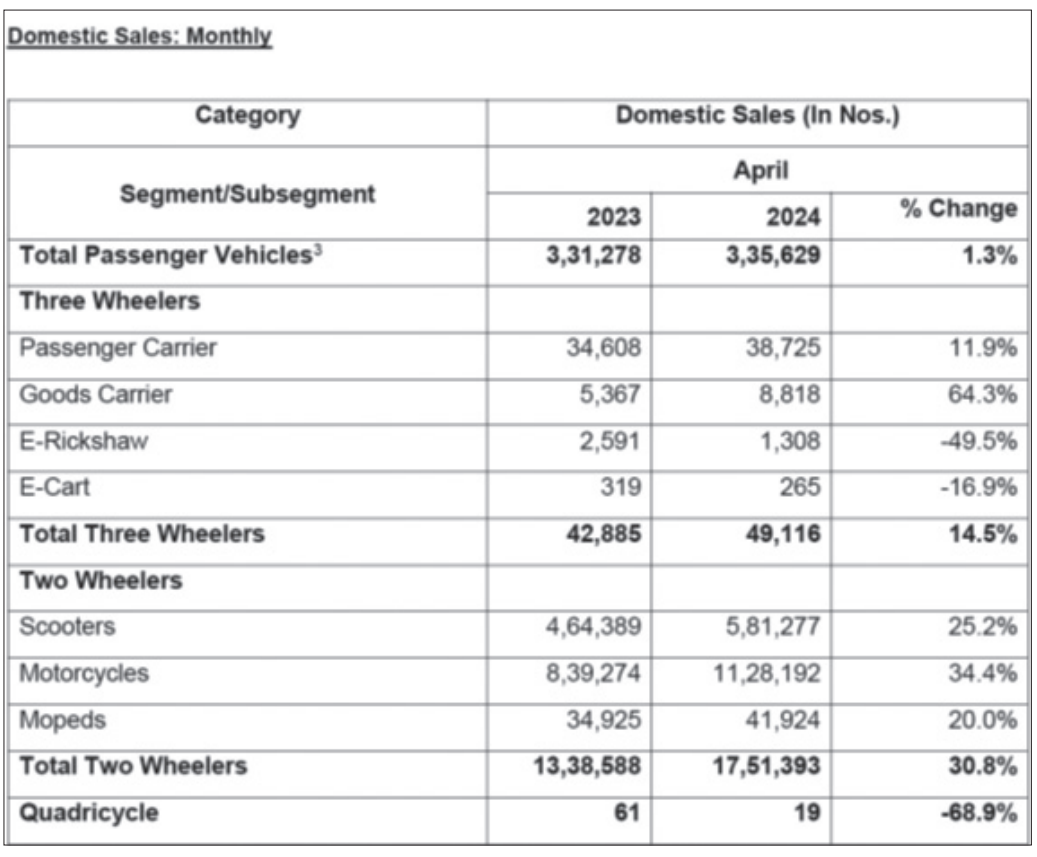

Aditi Nayar, Chief Economist, ICRA sees the dip in IIP growth on expected lines as the leap-year effect faded. Nayar observes that the yoy growth in a majority of the available high-frequency indicators witnessed an uptick in April 2024, including vehicle registrations, generation of GST e-way bills, petrol sales which zoomed to a 22-month high of above 14.1 per cent from above 6.9 per cent, partly owing to increased movement in the run-up to General Elections), output of Coal India and electricity generation to a six-month high of more than 9.6 per cent from more than 8.1 per cent, owing to rise in temperatures. “In contrast, the yoy performance of diesel sales to more than 1.4 per cent from more than 3.1 per cent, cargo traffic at major ports to more than 1.3 per cent from more than 3.6 per cent and finished steel consumption to more than 9.4 per cent from more than 9.6 per cent, albeit remaining quite robust deteriorated in April 2024 relative to March 2024.

Government data also shows cumulative growth rate for the period of April-March 2023-24 over the corresponding period of the previous year at 5.8 per cent. The cumulative growth rate of mining for the period of April-March 2023-24 over the corresponding period of the previous year is 7.5 per cent, manufacturing growth was 5.5 per cent and electricity growth, yoy, for the period of April-March 2023-24 was 7.1 per cent.

Joshi foresees a likely slowdown in gross domestic product (GDP) with growth averaging 4.9 per cent in the fourth quarter, compared with 6.2 per cent in the third. On the positive side, as Joshi points out, rural demand, which was a key drag for consumption last fiscal, could revive this fiscal. While early weather forecasts predict a normal monsoon this year, the lagged impact of the Reserve Bank of India’s rate hikes and regulatory tightening of credit could have a moderating impact, especially for urban consumption,” says Joshi.

“A lower fiscal impulse this year is further expected to dial down the capex support to growth in fiscal 2025 as government targets reducing fiscal deficit to 5.1 per cent of GDP from 5.8 per cent of GDP previous fiscal. A pickup in private capex is critical to sustain the investment momentum,” suggests Joshi.

Due to these factors, CRISIL expects gross domestic product growth to moderate to 6.8 per cent in fiscal 2025 over 7.6 per cent estimated for the past year.

Opinion2 years ago

Opinion2 years ago

Fashion7 years ago

Fashion7 years ago

Entertainment7 years ago

Entertainment7 years ago

Entertainment7 years ago

Entertainment7 years ago

Opinion2 years ago

Opinion2 years ago

Business News2 years ago

Business News2 years ago

Policy&Politics2 years ago

Policy&Politics2 years ago

Business News2 years ago

Business News2 years ago