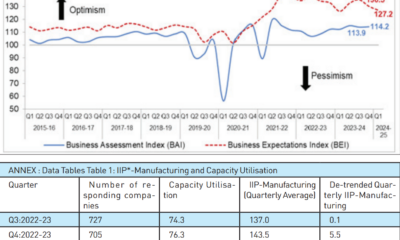

Business

6 Stunning new co-working spaces around the globe

Quis autem vel eum iure reprehenderit qui in ea voluptate velit esse quam nihil molestiae consequatur, vel illum qui.

The Daily Guardian is now on Telegram. Click here to join our channel (@thedailyguardian) and stay updated with the latest headlines.

For the latest news Download The Daily Guardian App.

Tech

Apple under spotlight as OpenAI, Google raise AI standards

Business

Paytm added to small-cap index by MSCI, attracting potential inflows

Economy

RBI warns NBFCs to stay alert for financial system risks

Business

Government e-marketplace records strong start in new fiscal with INR 8.57 lakh cr GMV

International Relations

French Summit sees tech & aero deals, TCS & Motherson invest

Business

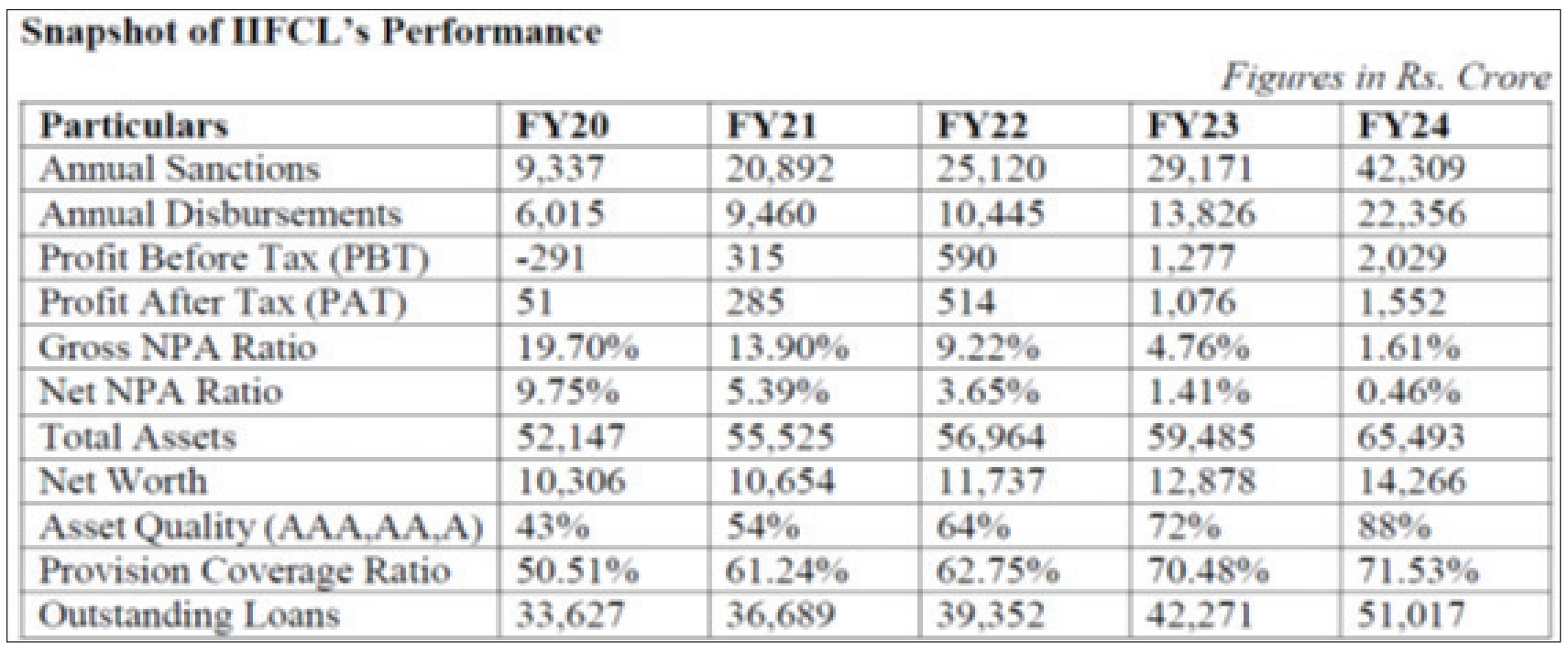

IIFCL posts highest ever sanctions of Rs 42,309 cr, PAT grows 44% in FY24

-

Opinion2 years ago

Opinion2 years agoPakistan-China nexus trying to sow doubts in Indian society about governance systems

-

Fashion7 years ago

Fashion7 years agoThese ’90s fashion trends are making a comeback in 2017

-

Entertainment7 years ago

Entertainment7 years agoThe old and New Edition cast comes together to perform

-

Entertainment7 years ago

Entertainment7 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Opinion2 years ago

Opinion2 years agoEnvironment day with a missing spring and lost souls

-

Business News2 years ago

Business News2 years agoIndia Becomes World’s 5th Biggest Economy

-

Policy&Politics2 years ago

Policy&Politics2 years agoA successful SME must understand his 5 wives

-

Business News2 years ago

Business News2 years ago‘75K STARTUPS DEFINE THE POWER OF INNOVATION’