Policy&Politics

How a grand reform like GST has come a cropper

The Daily Guardian is now on Telegram. Click here to join our channel (@thedailyguardian) and stay updated with the latest headlines.

For the latest news Download The Daily Guardian App.

Policy&Politics

Kejriwal unveils ‘Guarantee’ for LS Polls: AAP’s pledge for change

Economy

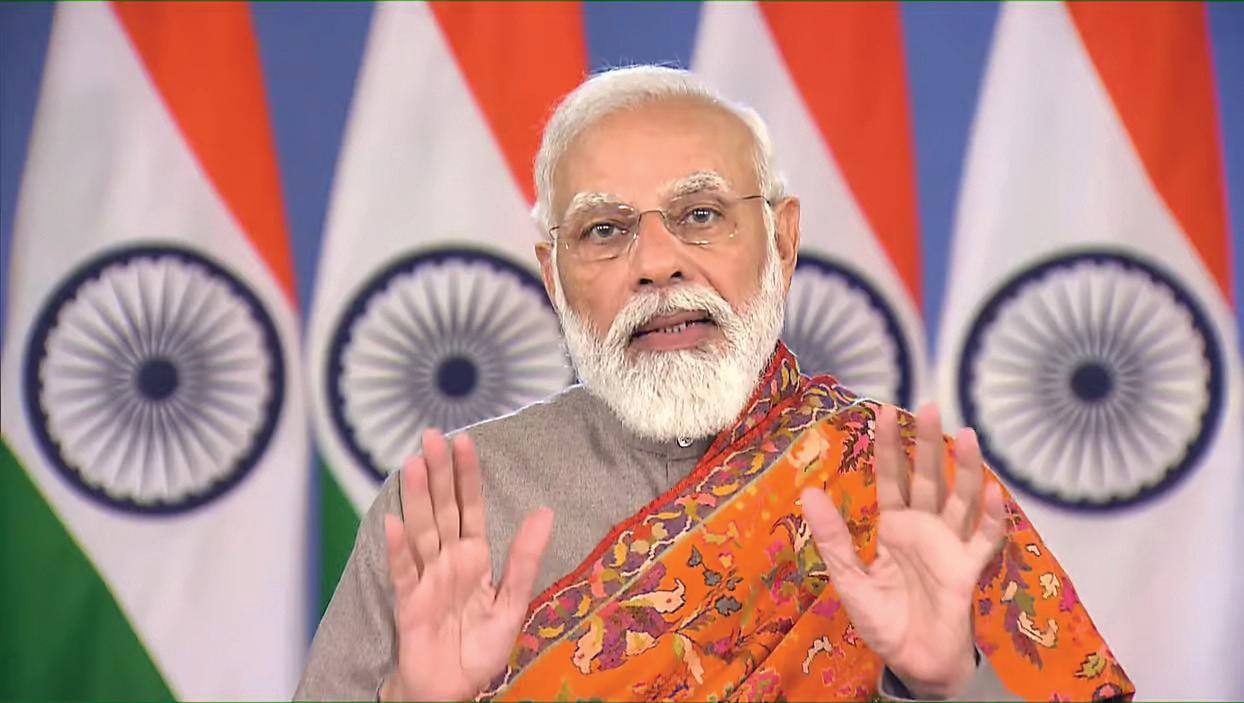

Macro & financial stability, boost to infra, extended PLI likely key areas in Modi 3.0

Policy&Politics

Govt extends date for submission of R&D proposals

Policy&Politics

India, Brazil, South Africa to press for labour & social issues, sustainability

Policy&Politics

India to spend USD 3.7 billion to fence Myanmar border

Policy&Politics

ONLY 2-3% RECOVERED FROM $2-3 TN ANNUAL ILLEGAL TRADE THROUGH BANKING: INTERPOL

-

Opinion2 years ago

Opinion2 years agoPakistan-China nexus trying to sow doubts in Indian society about governance systems

-

Entertainment7 years ago

Entertainment7 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Fashion7 years ago

Fashion7 years agoThese ’90s fashion trends are making a comeback in 2017

-

Entertainment7 years ago

Entertainment7 years agoThe old and New Edition cast comes together to perform

-

Opinion2 years ago

Opinion2 years agoEnvironment day with a missing spring and lost souls

-

Politics7 years ago

Politics7 years agoIllinois’ financial crisis could bring the state to a halt

-

Entertainment7 years ago

Entertainment7 years agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment7 years ago

Entertainment7 years agoMod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens