I. INTRODUCTION

The energy sector is one of the most essential and crucial parts of the Indian economy. For the development and growth of India, new policies new legislations are necessary for the welfare of the nations and the growth of the Indian economy. The demand for electricity in the country is increasing. If we compare, India’s power sector is diversified compared to so many developing countries where “Natural Gas” and “Renewables” play an essential role. India ranked sixth in the list of countries to make significant investments in clean energy at US$ 90 billion. Out of 25 nations that measure overall power, India ranked fourth in the Asia Pacific region. Furthermore, India ranked fifth in renewable power, fourth in wind power, fifth in solar energy according to the Installed capacity index 2018. With the rapidly increasing demand for electricity, India ranked 26th in the World Bank list accessibility in 2017. The Government of India (GOI) focuses on the “Power for all” policy. By 2022, 114 GW is estimated to contribute by solar energy, 67 GW from wind power and biomass and hydropower; it’s approximately 15 GW. Furthermore, by 2022 the target for renewable energy is also increasing by 227 GW. By October 2020 total installed capacity of power stations increased to 373.43 GW, and electricity production reached 1252.61 billion in FY20. The present paper analyses two current policies of the government, the EV (electricity vehicles) policy through which it aims to achieve a target where 70% of all the commercial cars, 30 % of private vehicles, and 80% two-wheeler ( 2W) and three-wheeler by 2030 but there are severe flaws as far as setting up the infrastructure is concerned due to a weak financial standing. The second part of the paper critiques the government’s Solar Power policy because of its heavy dependence on China’s hostile neighbour for raw material imports.

II. EV VEHICLES POLICY CRITIQUE

Electric vehicles are a rage in the modern automotive industry, with Tesla Inc. changing the market dynamics of the automotive industry with its ballooning valuation and swelling innovation in the EV market, which is forcing the existing automotive leaders like Volkswagen, General Motors, Toyota etc. to innovate and setting deadlines to switch to EV completely. Hence, it becomes imperative to look at the Indian EV market, especially the current laws and policies operating in India and their viability.

III. THE CURRENT INDIAN MARKET

The Indian EV market is still nascent, having a market share of 0.47 % in the Four-wheeler vehicle industry as of 2019. However, the government has announced some critical strategies towards adopting EVs in the Indian market. The government aims at 100% adoption of EV by 2030. In furtherance towards EV development, the central government had initiated the “Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME)” scheme for two years at an authorised disbursement of Rs. 795 Crore in the year 2015. Further, it was protracted until September 2018 and was concentrated on “technology development, demand creation, pilot projects and charging infrastructure.” In phase II of ‘FAME’, it was intentioned to increase the monetary backing of Rs further. 8,730 Cr for three years. The government shall be principally targeting the placement of electric buses plying in the Indian markets.

The NITI Aayog, in its 2020 report, stated that “India’s electric vehicle financing industry projected to be worth Rs 3.7 lakh crore in 2030.” Some of the government’s effective plans include setting up infrastructure for 69,000 EV charging stations across India, charging stations at every 25 km, taxation benefits for EVs, etc. The Supreme court (SC) has also stated the importance of EVs, especially about the environment. So, it can be perceived that the Indian government is determined about the adoption of EVs in the Indian market.

IV. RELIANCE ON DISCOMS FOR EV

The Electricity sector in India falls under the concurrent list of the Indian constitution and is managed by the central and state governments concurrently. The Electricity distribution companies in India (Discom) are driven mainly by the state governments and are mostly government-owned companies. However, they aren’t the producers of electricity. Discoms procure electricity from the producers and then retail it in the market through their distribution infrastructure.

In the EV policies of the Indian government, discoms play a critical role. In its “Charging Infrastructure for Electric Vehicles – Guidelines and Standards”, the Ministry of Power stated that the Discoms are responsible for facilitating the charging points for EVs in Offices and private residences. Similarly, the guidelines proposed that Discoms shall be the default Nodal agency in a state to set up infrastructure for charging, subject to the state governments discretion. Similarly, under the “Amendments in Model Building Bye-Laws (MBBL – 2016) for Electric Vehicle Charging Infrastructure”, most of the aspects relating to charging, inspection, certification etc., of charging stations are the responsibility Discoms. Hence, the discoms play a vital role in developing EVs in India.

However, as can be seen in the next section, the Discom companies are operationally inefficient and financially unhealthy even to complete their existing duties.

V. THE DISCOM ISSUE

One of the essential requirements for the successful setting-up of EV infrastructure in India is the healthy condition of discoms. Discoms in India has been facing heavy debts, which in FY2022 is in the tune of Rs. 6 trillion. To correct this massive debt, the government of India launched the “The Ujwal DISCOM Assurance Yojana (UDAY scheme)” in November 2015. UDAY envisioned that state governments are taking over seventy-five per cent of the utilities’ debts, thus reducing the interest burden on the discoms. In turn, the discoms were to progress their monetary and operative parameters through various reformative measures and turn out to be financially healthy companies.

However, the objectives of UDAY were never fulfilled as the debts of the discoms decreased. Until now, only seven states, including HP, AP, TN, Gujarat, Kerala, Telangana & Goa, have enumerated losses under 15 %, and the remaining states have been unsuccessful in accomplishing even these numbers.

UDAY also necessitates income to lower the gap amongst “average cost of supply and average revenue realised to zero.” Instead of dropping the opening, most states like the then J&K, Goa, Punjab, Manipur and Goa — have widened the gap in the previous few years. A study shows that even after four years of the implementation of the Scheme, the debts of these discoms companies were as of that of pre-2015 level. Most studies have concluded that the Discom scheme was a failure. The Ministry of power, in March 2020, has announced the formulation of the revamped system, UDAY 2.0, for yet again resurrecting the Discoms. Still, as of March 2021, no new constructive steps have been taken by the central government in that regard.

VI. REFORM OR PRIVATISE: A WAY AHEAD

Instead of reforms in discoms, the government has intended to privatise them to increase their efficiency. However, this push for privatisation has been met with stiff opposition by State governments, employees and opposition parties.

The Ministry of power has introduced a Standard Bidding Document (SBD) which envisions permanent privatisation of Discoms in India. The contentious terms of the SBD are:

a. “Employees of the existing distribution licensee shall be transferred to the successor entity.”

b. “Assets of the existing distribution licensee, other than land, will be transferred to the new entity at Net Asset Value. Land owned or in possession of the existing distribution licensee shall be provided to the successor entity on the right to use basis at nominal charges.”

These terms proposed in the SBD for the privatisation of income directly contradict many Supreme court’s (SC) judgements.

InBCPP Mazdoor Sangh & Anr v. NTPC, wherein the employees of NTPC were transferred to the BALCO (which was being privatised), the SC held: “It is clear that no employee could be transferred without his consent from one employer to another. The government or its instrumentality cannot alter the conditions of service of its employee.”

In Jawaharlal Nehru University v. K.S Jawatkar, it was observed that “the position in law is clear, that no employee can be transferred, without his consent, from one employer to another.”

In H.L Trehan v. Union of India, it was held, “It is now a well-established principle of law that there can be no deprivation or curtailment of any existing right, advantage or benefit enjoyed by a Government servant without complying with the rules of natural justice by giving the Government servant concerned an opportunity of being heard. Any arbitrary or whimsical exercise of power prejudicially affecting the existing conditions of service of a Government servant will offend against the provision of Article 14 of the Indian Constitution.”

Therefore, the provision by the government in the SBD wherein the employees will be transferred to the transferee company unilaterally by the government violates the tenets of natural justice and is violative of the SC mandate.

Further, under Sec.131 (2), “Electricity Act 2003”, it specifies that: “Provided that the value of the transfer of any assets transferred hereunder shall be determined, as far as may be based on the revenue potential of such assets….” Consequently, any rule by the government in which the assets shall be sold at “Net Asset Value” and the Land assets will be sold-off at minimal charges is violative of the provisions of the “Electricity Act, 2003.”

Furthermore, under Sec. 22 (2)(m), “The Electricity Regulatory Commissions Act, 1998”, the State Electricity Regulatory Commission (SERC) is mandated by parliament to assess the net value of the assets of the Discoms. However, as stated, the power sectors in every state are running into losses to the tune of thousands of crores. By looking at the contemporary times, mainly due to the COVID-19 recession, the states will face extreme financial hardships to assess the net worth of the discoms.

VII. ANALYSIS OF INDIAN SOLAR POLICY

•Paris Declaration on the ISA 2015

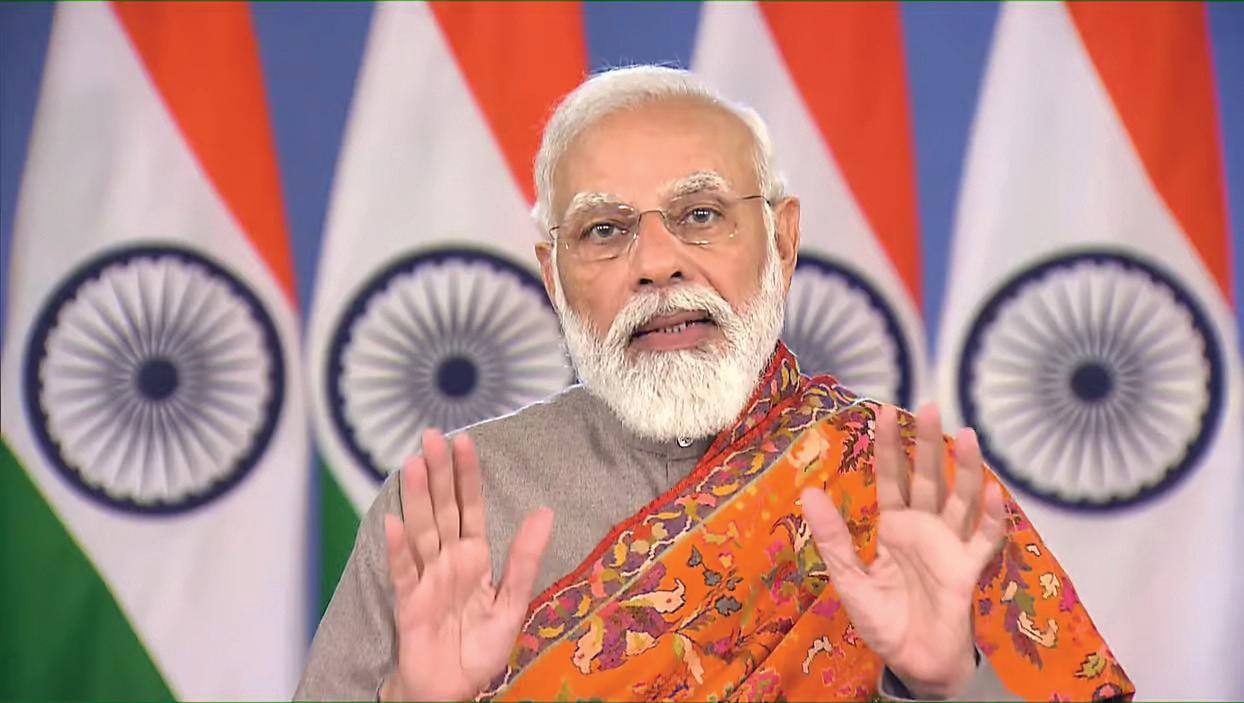

Prime Minister Narendra Modi and former French President Francois Hollande announced the launch of the International Solar Alliance at the 21st session of the UN climate change conference of the parties (COP-21) to promote and promote solar energy efficiently. ISA is a treaty agreement of solar-rich nations between the tropic of cancer and the Tropic of Capricorn. The funding is received from members of ISA, partner countries, the private sector and the UN. As of now, eighty-nine countries have signed the agreement, and seventy-two have submitted their instruments of ratification. The primary goal of the framework agreement is to bring down the solar cost and mobilise more than $1,000 billion by 2030. In the Energy investment meeting an expo 2020, PM had urged global investors to join the production linked incentive scheme for manufacturing high-efficiency solar power modules in the county.

•India’s Dependence on China (a Hostile Neighbour) for Solar Equipment

India’s solar sector is heavily dependent on China to import solar equipment. Solar modules account for 60% of any solar project’s cost, and Chinese firms supply about 80% of such solar modules to India. “India is dependent mainly on China for 80-90 per cent of the solar equipment required for meeting the ambitious target by 2022,” i.e., out of total import worth $1.5 billion, $1.2 billion is imported from China. For FY20, the aggregate value of the solar cell or photovoltaic imports stood at $1,525.8. Low prices, as stated above, is one of the reasons why India’s heavily relied on supply from Chinese companies. As the Minister of renewable energy, RK Singh, said, “The solar panels or modules imported from China are generally cheaper than those produced by domestic manufacturers”.

Such heavy dependence on a county with which we do not have cordial diplomatic relations poses a threat to the very aim of India’s solar power mission. Narendra Taneja, an Energy expert, observed, “it is not smart that India should be dependent upon imports”. He raised concerns regarding 40 GW of the capacity that is bid out or auctioned; the process involves investments of about Rs. 2 lakh crore for acquiring the solar modules.

It is always unsettling to see India’s contemporary discourse, and it is nothing less than trouble for policymakers. “It is an ever-growing power asymmetry, the uncertainty of future intentions and a fluid geopolitical context that surrounds the relationship”. India lags on every primary material indicator – or comprehensive national strength as the Chinese call it – by a margin that is not surmountable in the foreseeable future. This differential of power has widened in the past decade, which might explain a part of the crisis in the relationship and China’s reluctance to adopt a different Indian policy in the absence of any compelling reason to do so. If we look at what Chinese strategists say, there is an unwillingness to bet on India’s future foreign policy. The dominant belief among Chinese scholars seems to be that India has already chosen the other side or has crossed a tipping point. There is a massive power gap between the two counties, “there is probably no international example of a modus vivendi under such circumstances where one rising power has raced substantially ahead of another rising power”. That being mentioned, the contentious territorial issues only worsens the situation and increase apprehension.

With this amount of apprehension and lack of confidence, entirely depending on our Power policy on imports from China that too without any alternate recourse in or backup, is nothing short of a policy blunder. It is essential to mention that China has neither ratified the ISA nor signed it. Therefore, India has no legal protection or recourse if a crisis arises between the two countries.

As far as India’s domestic manufacturers are concerned, Adani Green, Vikram Solar, Waare Energy, Tata Power Solar etc., have a capacity of appx 8 GW to manufacture modules which is the main component of solar equipment. Most companies have a meagre manufacturing capacity and are dependent on imports from China. The solar power market sees widespread developments in the technology, which prevents local manufacturers from investing in advanced research and development to offer upgraded production standards due to lower returns.

•Government’s Plans to Switch to Alternative Sources

The minister informed that the solar industry would switch to alternate sources or domestic suppliers following the coronavirus outbreak and was not compelled to import from china. Further, the government is promoting solar equipment manufacturing by domestic suppliers through schemes such as M-SIPS, PM-KUSUM, CPSU scheme, grid-connected rooftop solar programme, and by setting up photovoltaic manufacturing units.

Increasing the essential customs duty (BCD) looks like an effective recourse given the anti china mood in the country. JMK research finds “with ongoing border issues; 20% of the BCD will likely be applicable on imported solar modules instead of 10%”. Therefore safeguard duty can bring a drop in imports from China.

To further decrease import dependence on china and boost domestic manufacturing, India had imposed a 25 % SGD on Solar imports from China and Malaysian 2018, which was reduced to 20% and 15% in the years 2020 and 2021, respectively. Additionally, to lower the cost of interest charged to the developers of domestically manufactured equipment, financing from IREDA( Indian Renewable energy development agency), REC (rural electrification corporation) and Power finance corporation will be structured.

VIII. CONCLUSION

The government of India has ambitious policies regarding the embracing of EVs in India and becoming a world leader in the renewable energy sector. This can be stipulated from the fact that India is facing rising environmental and energy concerns. India is an energy-hungry nation, with most of its current energy requirements fulfilled by imports. The adoption of EVs shall improve the balance of payments for India, which suffers quite a drain due to energy imports. However, Discoms will play a crucial role in this development. As discussed in this paper, the government’s current policies for the revival of discoms are ineffective at best and unsuccessful at worst. Further, the government’s policies in promoting EVs rely heavily on the discoms. Hence, it is suggested that the government reformulate and restrategise its policies towards the functioning of discoms. A financially weak and inefficiently functioning discom industry shall play a massive hurdle towards the government’s ambitions to develop the EV industry in India.

The solar policy and mission of the International solar alliance will not be an overstatement to say that this policy will be nothing short of a blunder because of its heavy dependence on imports from China, which is a hostile neighbour and cannot be trusted. Entirely basing so big a project on a fragile diplomatic relation poses a threat to India’s credibility at both national and international levels. It is suggested that the government must divert all its efforts and resources in boosting the manufacturing capacity of domestic developers to reduce its dependence on China significantly. Further, unless the alternatives are put in place, the government must execute an agreement with China to have legal recourse in crisis cases.

Opinion3 years ago

Opinion3 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Fashion8 years ago

Fashion8 years ago

Opinion3 years ago

Opinion3 years ago

Politics8 years ago

Politics8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago

Entertainment8 years ago