Economy

India shines as global growth dims, boasts strong performance to World bank

The Daily Guardian is now on Telegram. Click here to join our channel (@thedailyguardian) and stay updated with the latest headlines.

For the latest news Download The Daily Guardian App.

International Relations

China Vows firm response to US tariff hike

Economy

RBI warns NBFCs to stay alert for financial system risks

Economy

India cuts oil windfall tax again, now down to Rs 5,700 per tonne

International Relations

French Summit sees tech & aero deals, TCS & Motherson invest

International Relations

India and Iran vow to deepen maritime ties

Economy

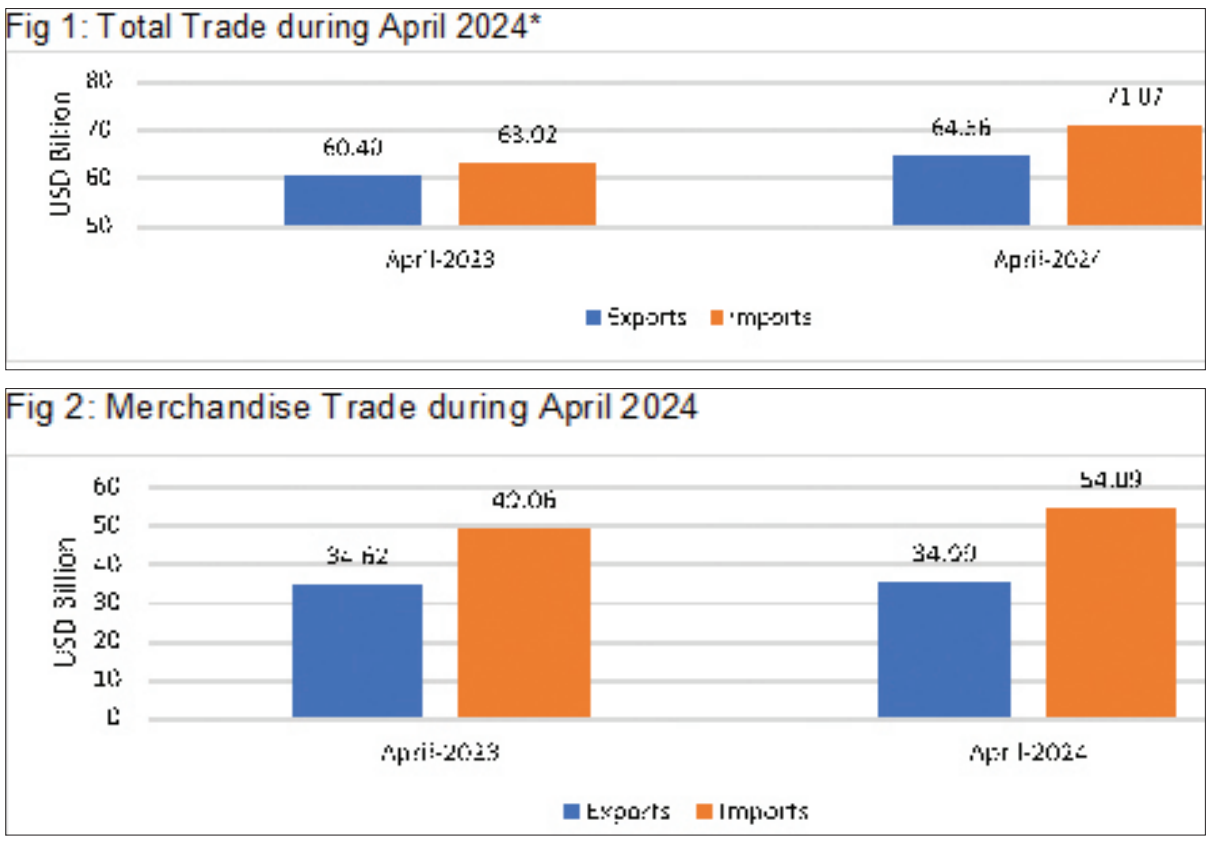

India’s merchandise exports grow marginally by 1.08 % to $ 34.99 bn

-

Opinion2 years ago

Opinion2 years agoPakistan-China nexus trying to sow doubts in Indian society about governance systems

-

Entertainment7 years ago

Entertainment7 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Fashion7 years ago

Fashion7 years agoThese ’90s fashion trends are making a comeback in 2017

-

Entertainment7 years ago

Entertainment7 years agoThe old and New Edition cast comes together to perform

-

Opinion2 years ago

Opinion2 years agoEnvironment day with a missing spring and lost souls

-

Politics7 years ago

Politics7 years agoIllinois’ financial crisis could bring the state to a halt

-

Entertainment7 years ago

Entertainment7 years agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment7 years ago

Entertainment7 years agoMod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens